|

The score in this race is very tight. The US was the obvious leader at the beginning of the pandemics, but later this begun to change.

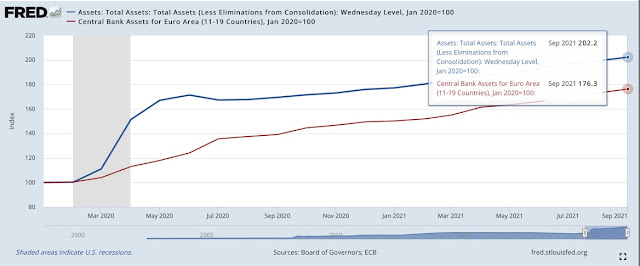

1st perspective - from Jan 1, 2020, till now

|

| 1. Fed, ECB balance sheet expansion - Jan 2020 - Sept 2021 |

The US is the clear leader with +102.2% growth of the Fed balance sheet. The Euro Area result is 76.3%

2nd perspective - June 2020 - September 2021

Here, Europe is leading by 30.0% to 20.8%.

|

| 2. Fed, ECB balance sheet expansion - Jul 2020 - Sept 2021 |

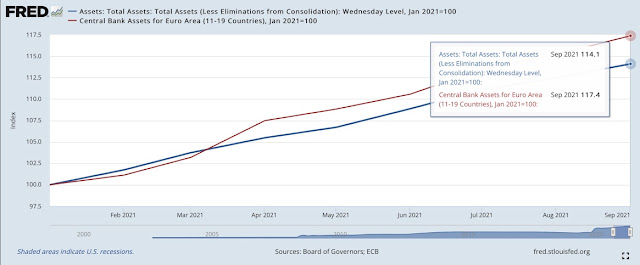

3rd perspective - Jan - Sept 2021

Europe is still leading with a narrow margin - 17.4% to 14.1%.

|

| 3. Fed, ECB balance sheet expansion - Jan 2021 - Sept 2021 |

The ECB remains the winner by 3.4% to 2.7%.

|

| 4. Fed, ECB balance sheet expansion - Jul 2021 - Sept 2021 |

The first data for September 2021 shows that Fed may be back. During the first two weeks of September, the Fed expanded its balance sheet by 1.2%, compared to the ECB expansion of 0.7%.

According to our research published in another article, when Fed and ECB print money at the same pace, the USD has a tendency to appreciate (and EUR/USD falls).

The Data Shows How EUR/USD Has Reacted For Changes In Money Supply

Data credits:

1. Board of Governors of the Federal Reserve System (US), Assets: Total Assets: Total Assets (Less Eliminations from Consolidation): Wednesday Level [WALCL], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/WALCL, September 27, 2021. European Central Bank, Central Bank Assets for Euro Area (11-19 Countries) [ECBASSETSW], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/ECBASSETSW, September 27, 2021.

2. Board of Governors of the Federal Reserve System (US), Assets: Total Assets: Total Assets (Less Eliminations from Consolidation): Wednesday Level [WALCL], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/WALCL, September 27, 2021. European Central Bank, Central Bank Assets for Euro Area (11-19 Countries) [ECBASSETSW], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/ECBASSETSW, September 27, 2021.

3. Board of Governors of the Federal Reserve System (US), Assets: Total Assets: Total Assets (Less Eliminations from Consolidation): Wednesday Level [WALCL], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/WALCL, September 27, 2021. European Central Bank, Central Bank Assets for Euro Area (11-19 Countries) [ECBASSETSW], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/ECBASSETSW, September 27, 2021.

4. Board of Governors of the Federal Reserve System (US), Assets: Total Assets: Total Assets (Less Eliminations from Consolidation): Wednesday Level [WALCL], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/WALCL, September 27, 2021. European Central Bank, Central Bank Assets for Euro Area (11-19 Countries) [ECBASSETSW], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/ECBASSETSW, September 27, 2021.