At these times it may be good to know which assets are undervalued or overvalued in relation to the growing money supply. We checked some most obvious alternatives.

|

| 1. Dow Jones Industrial Average vs. M2 money supply, 2018/01/01 = 100 |

The M2 money supply aggregate has grown 51.3% since the beginning of 2018. The Dow Jones Industrial Average growth (34.4%) was not that dynamic. Does this mean that US stocks are still undervalued?

Data Shows - US & Euro Area Interest Rates Are Irrelevant To EUR/USD Rate

On the one hand, the attached chart clearly shows that until the beginning of 2020, the increase in the value of the shares kept pace with the increase in the M2 indicator. But can we expect this tendency to continue? This would probably be the case if stocks were the only available investment. And of course, it is not, and investors' preferences may change dynamically.

|

| 2. M2 money supply vs. Bitcoin and Ethereum coin base, 2018/01/01 = 100 |

If there are any assets that we can certainly consider to be overvalued in relation to the growth of the money supply, these would be the major cryptocurrencies. The dynamic M2 growth line looks almost flat when compared to the 255.4% growth of bitcoin and 205.7% growth of ethereum.

How Does A Change In Interest Rates Affect Inflation In The Real Life?

If you are rather interested in investments that are undervalued in relation to the money printing pace, you may want to consider real estate. Unlike in the case of cryptocurrencies, if your investment really goes south, you will be still left with something that you still can sell.

|

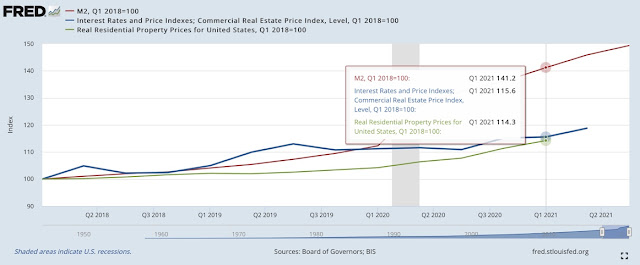

| 3. M2 money supply vs. commercial and residential real estate prices, 2018/01/01 = 100 |

The US real estate prices have grown just 15.6% (commercial) and 14.3% (residential). Less than M2 and surely much less than cryptocurrencies.

It also may make sense to have a look at gold. Especially that it also looks undervalued in relation to M2.

|

| 4. M2 money supply vs. gold, 2018/01/01 = 100 |

The gold prices grew just 33.6% since January 2018, which may be seen as an interesting opportunity.

2. Board of Governors of the Federal Reserve System (US), M2 [M2SL], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/M2SL, November 4, 2021. Coinbase, Coinbase Bitcoin [CBBTCUSD], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/CBBTCUSD, November 4, 2021. Coinbase, Coinbase Ethereum [CBETHUSD], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/CBETHUSD, November 4, 2021.

3. Board of Governors of the Federal Reserve System (US), M2 [M2SL], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/M2SL, November 4, 2021. Board of Governors of the Federal Reserve System (US), Interest Rates and Price Indexes; Commercial Real Estate Price Index, Level [BOGZ1FL075035503Q], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/BOGZ1FL075035503Q, November 4, 2021. Bank for International Settlements, Real Residential Property Prices for United States [QUSR628BIS], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/QUSR628BIS, November 4, 2021.