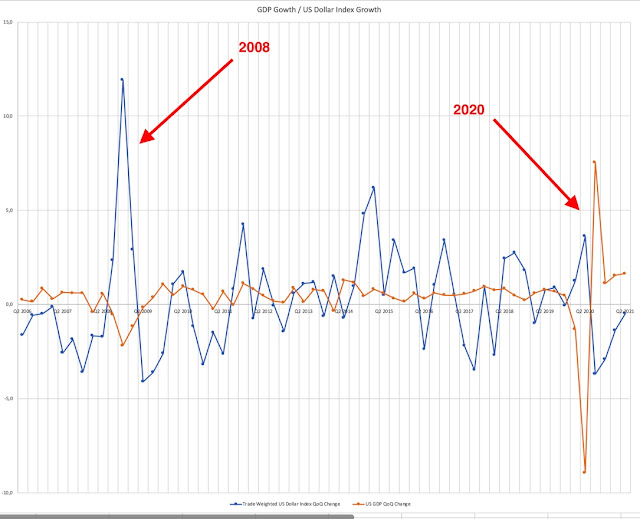

As we recently discovered, there is a visible negative correlation between the trade-weighted US dollar index and the quarter-on-quarter GDP growth. According to simple rules of economics, a more dynamic economy requires more currency to serve a growing volume of transactions. This means that the currency in question is more demanded and should appreciate. The discovered relation cannot be described otherwise than surprising.

Data shows that US and Euro Area interest rates are irrelevant to EUR/USD exchange rate

The correlation coefficient value is -0.36. The relation was visible very clearly during the two recent recessions of 2008 and 2020. The US dollar has a tendency to appreciate while everything else falls.

The relation is shown on the chart below. The recessions are marked by arrows.

|

| US GDP growth vs. the dollar index growth |

In fact, this discovery puts the whole idea of USD fundamental trading in a new perspective. It also requires some further research, especially with regards to the EUR/USD exchange rate.

Some real data about EUR/USD moving averages

More data from our EUR/USD moving average experiment

Data source: Board of Governors of the Federal Reserve System (US), Trade Weighted U.S. Dollar Index: Broad, Goods and Services [DTWEXBGS], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/DTWEXBGS, October 4, 2021. U.S. Bureau of Economic Analysis, Real Gross Domestic Product [GDPC1], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/GDPC1, October 4, 2021.